So I got the dreaded Terms & Conditions Update letter for one of my credit cards yesterday and given all of the craziness that the banks have seen over the last two years, I was expecting the absolute worst. That said, here are the particular changes that stood out to me…

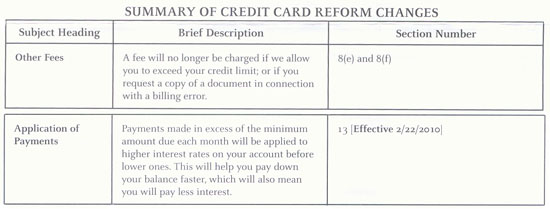

Yeah, so whereas Chase has been jerking me around with insane APRs after taking my promo rate away some time ago, Wachovia is actually reducing the potential for fees and making it easier to pay off my balances by targeting the highest APRs first! This is fantastic news because on this particular card we have a little bit of money that was getting charged 11.99% while the majority is at a sweet 3.25% for the life of the balance. Chase actually did something similar to me many years ago when I bought a car because I was stupid and took out a cash advance to cover the taxes on it … I think I probably paid for that $700 two or three times over with the 24% interest because it was the very last thing to get paid off on the balance.

Next year is going to be a big year for finally settling up the bulk of our credit card debts as we prepare to take the next big step in life, so it’s refreshing to see a bank actually trying to work with us to make those kinds of things happen. It’s this kind of attitude that makes me want to continue banking with Wachovia in the future, not just until I stop owing them money.